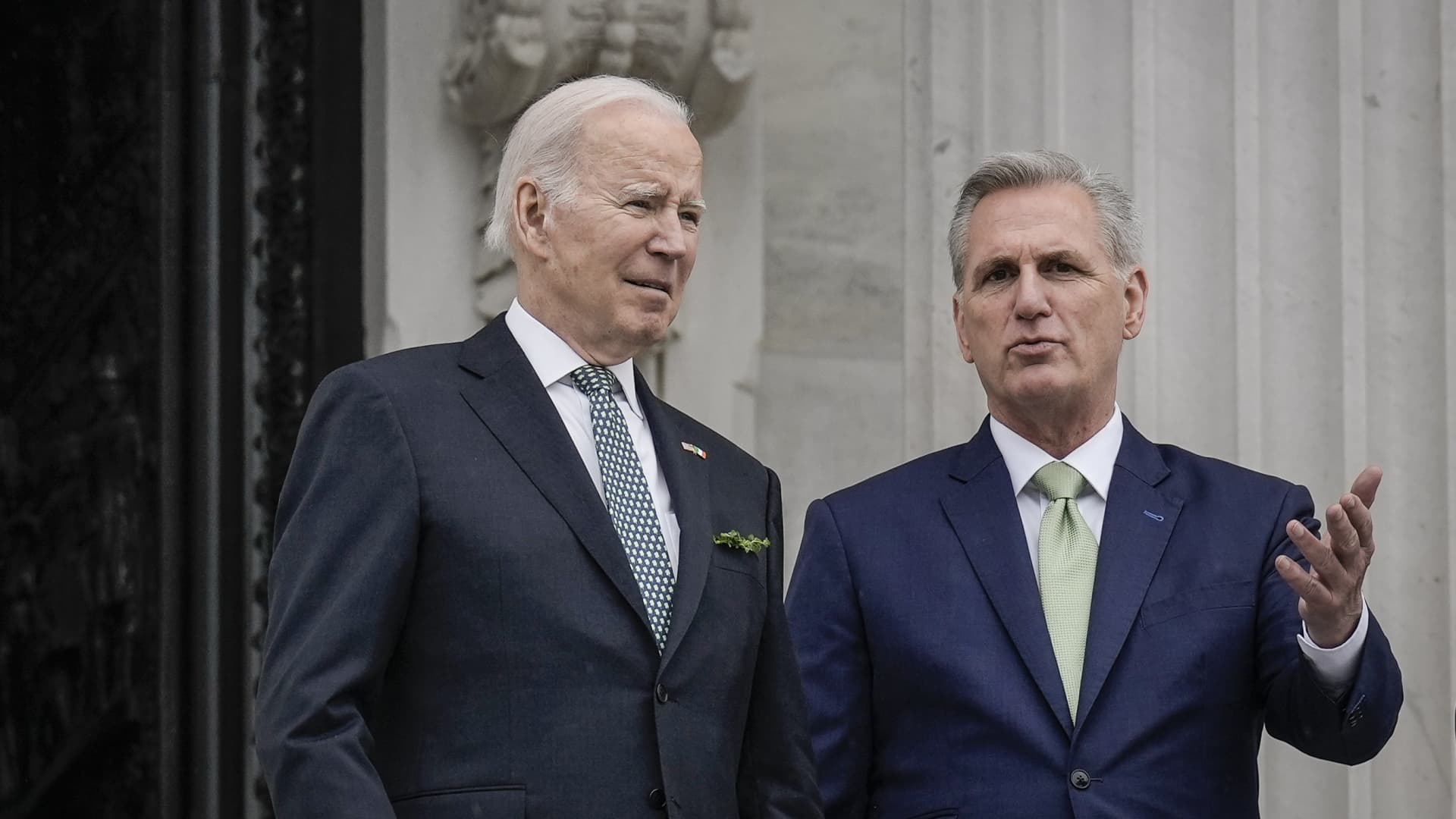

Washington, D.C. – March 17, 2023: President Joe Biden and House Speaker Kevin McCarthy speak outside the Annual Friends of Ireland Luncheon at the U.S. Capitol.

Drew Angerer | Getty Images News | Getty Images

The U.S. is in a weaker position now than when S&P downgraded its sovereign credit rating in 2011, according to the former chairman of the agency’s Sovereign Rating Committee.

The world’s largest economy is once again facing the prospect of a government shutdown unless lawmakers in Washington can pass a spending bill before an Oct. 1 deadline.

House Speaker Kevin McCarthy cannot afford to lose more than four votes among fellow Republicans in the House of Representatives, but faces resistance from hard-right members within his caucus, who are demanding deeper domestic spending cuts.

Moody’s earlier this week warned that a government shutdown would harm the country’s credit, after Fitch downgraded the long-term U.S. sovereign credit rating by one notch in August on the back of the latest political standoff over raising the debt ceiling.

S&P controversially downgraded the long-term credit rating from the AAA representing a “risk free” rating to AA+ as early as 2011, citing political polarization after another debt ceiling squabble in Washington.

John Chambers, former chairman of the Sovereign Rating Committee at S&P Global Ratings at the time of that 2011 downgrade, told CNBC’s “Capital Connection” on Tuesday that a government shutdown is likely and that the whole episode was a “sign of weak governance.”

This was a factor that led to S&P’s downgrade of 2011, and Chambers said the U.S. fiscal position is now even weaker than it was back then.

“Right now the deficit of the general government — which is the federal and the local governments combined — is over 7% of GDP and the government debt is 120% of GDP. At the time, we forecasted that it might get to 100% of GDP, and the government ridiculed us for being too scaremongering,” he said.

“The external position is about the same, but I think the governance has weakened and the fractiousness of the political settings is much worse, and that has led to government shutdowns, it’s led to fears that the government might default on its debt because of the debt ceiling, and it’s led to a failed coup d’état on the 6th [of] January, 2021.”

House Speaker McCarthy needs almost all of his Republican colleagues on the side, but the Freedom Caucus, which had 49 members in January, has stalled budget negotiations by demanding harsher domestic spending cuts.

McCarthy may seek help from Democrats to shore up the necessary votes to avoid a shutdown, but hardline Republicans have discussed ousting him as Speaker if such a compromise is agreed.

In May of this year, another standoff between the White House and opposition Republicans over raising the U.S. debt limit once again pushed the world’s largest economy to the brink of defaulting on its bills, before President Joe Biden and House Speaker Kevin McCarthy struck a last-minute deal.

In its August downgrade, Fitch cited “expected fiscal deterioration over the next three years” and an erosion of governance in light of “repeated debt-limit political standoffs and last-minute resolutions.”

However, the downgrade was dismissed by many big-name bank bosses and economists as largely immaterial.