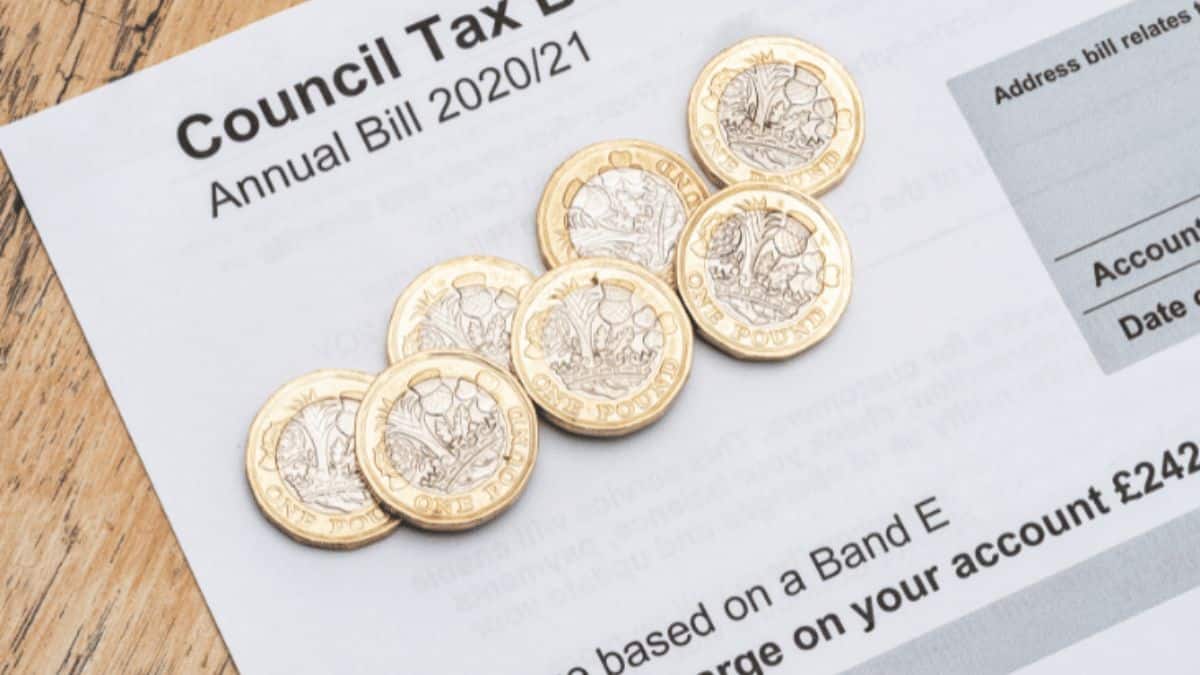

Council tax is a significant expense for many households, but did you know that one in four people who challenged their council tax band last year successfully reduced their bill?

£10 sign up bonus: Earn easy cash by watching videos, playing games, and entering surveys.

Get a £10 sign up bonus when you join today.

That’s right—over 10,000 households with their council tax band lowered, potentially saving them hundreds of pounds.

If you think your home might be in the wrong band, it could be worth challenging it. Here’s everything you need to know about how to go about it.

Why challenge your council tax band?

Your council tax band is based on the value of your property in April 1991 (for homes in England and Scotland) or April 2003 (for homes in Wales).

If the original valuation was wrong or if changes have been made to your property since then, you might be paying more than you should.

The government’s Valuation Office Agency (VOA) handled 39,590 council tax challenges last year, and 27% of them resulted in a lower band.

That means those households will now pay less council tax and may even get a refund for the overpayments they’ve made in the past.

How to check if you’re in the right band

Before you make a formal challenge, it’s important to do a bit of research:

- Check your neighbours’ bands: If your neighbours have similar properties but are in a lower band, this could be a sign that your band is wrong. You can compare your property’s band with others on the VOA or Scottish Assessors Association (SAA) websites.

- Assess your property’s value: Use the Nationwide House Price Index calculator to estimate what your home was worth in 1991 (or 2003 in Wales). If the value suggests you should be in a lower band, you might have grounds for a challenge.

- Contact the VOA: If your research indicates that your home is in the wrong band, you can ask the VOA to review it. You’ll need to provide evidence to support your case, but if the review is successful, your council tax band will be lowered.

Making a formal challenge

If you’re confident that your band is incorrect, you can make a formal proposal to the VOA.

This is different from a band review and doesn’t require you to provide evidence upfront. However, if your proposal is rejected, you can appeal to the Valuation Tribunal.

It’s worth noting that there is a small risk your band could be moved up instead of down, which would increase your bill. But this is rare—only 0.08% of challenges resulted in a higher band last year.

Other ways to reduce your council tax

Even if your band is correct, there are other ways to reduce your council tax bill:

- Single person discount: If you live alone, you could get a 25% discount.

- Discounts for disregarded persons: You may also get a discount if you live with someone who isn’t counted for council tax purposes, such as a full-time student or someone under 25 in approved training.

- Hardship relief: If you’re struggling to pay your council tax, your local council may offer support, including payment rescheduling, discounts for low-income households, or even hardship relief.

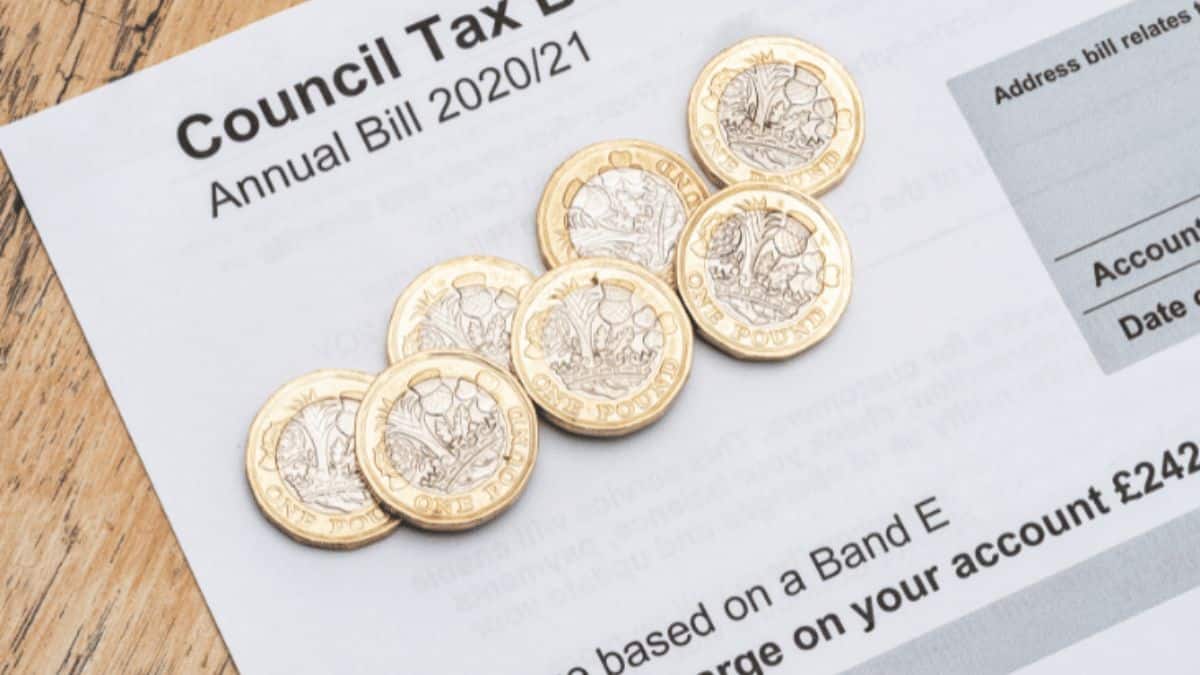

What happens if you can’t pay?

It’s important not to ignore your council tax bill. If you’re having trouble paying, contact your local council as soon as possible.

They can offer support, but if you don’t pay after receiving a final notice, the council can take legal action, which might include sending in bailiffs or taking the money directly from your wages.

Final thoughts

Challenging your council tax band could save you a significant amount of money. By checking your band, doing some research, and contacting the VOA, you might find that you’re entitled to pay less.

And even if your band is correct, there are still other ways to reduce your bill and get financial support if you need it.