If you’re in the software-as-a-service (SaaS) space, understanding market dynamics is key

What does the data say about SaaS growth rates? How much do companies typically spend on SaaS solutions? And what factors do brands consider when making SaaS purchases?

Let’s dive into the latest SaaS stats to find out.

SaaS Industry Statistics Highlights

- The global SaaS market is set to generate nearly $819 billion in 2029

- The U.S. SaaS market is projected to surpass $445 billion by 2029

- Almost 50% of all venture capital investments were made in SaaS startups in 2023

- Microsoft is the SaaS company with the largest market capitalization (the total value of a company’s publicly traded shares) in the world at more than $3 trillion

- Artificial intelligence (AI) software is the biggest SaaS sector based on customer count, with 3 billion global customers

- Organizations use 130 SaaS apps on average

- The average B2B SaaS churn rate is -1.59%

- Globally, the SaaS inflation rate is nearly four times higher than the market inflation rate

SaaS Overall Market and Growth Statistics

General SaaS Market Stats

The SaaS industry continues to expand rapidly, driven by increasing global demand and advancements in cloud technology.

Here are some key figures that capture the growth and scale of the worldwide SaaS market:

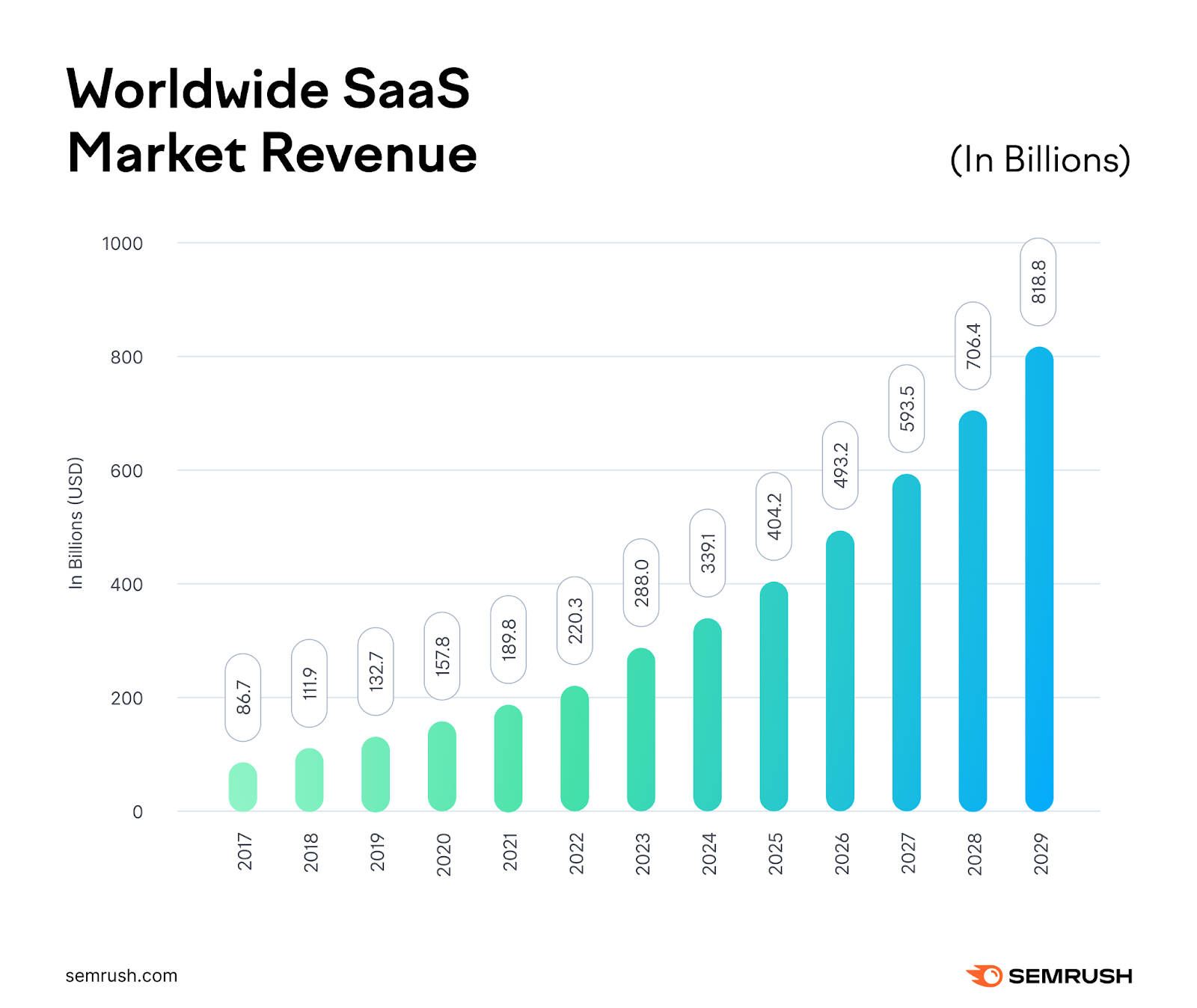

- Global SaaS market revenue is projected to reach $818.8 billion by 2029 (Statista, 2024)

Image Data Source: Statista

- The global SaaS market is expected to grow at a compound annual growth rate of 13.7% from 2023 to 2030 (Grand View Research, 2023)

- The North American SaaS market alone was valued at $131.18 billion in 2023 (Fortune Business Insights, 2024)

- In 2022, the global cloud computing market was valued at $413 billion, and SaaS made up $185 billion of that total (Statista, 2023)

Funding

Venture capital is a major source of funding for the SaaS industry, with significant investments flowing into SaaS solutions across a range of sectors.

Here are some stats revealing where funding is being allocated within the SaaS space:

- Nearly 50% of all venture capital investing was in SaaS startups in 2023 (Dealroom, 2023)

- The top-funded SaaS industries are financial services software and AI software—each having received nearly $40 billion in funding. Analytics software is in third place, with around $30 billion in funding. (Statista, 2024)

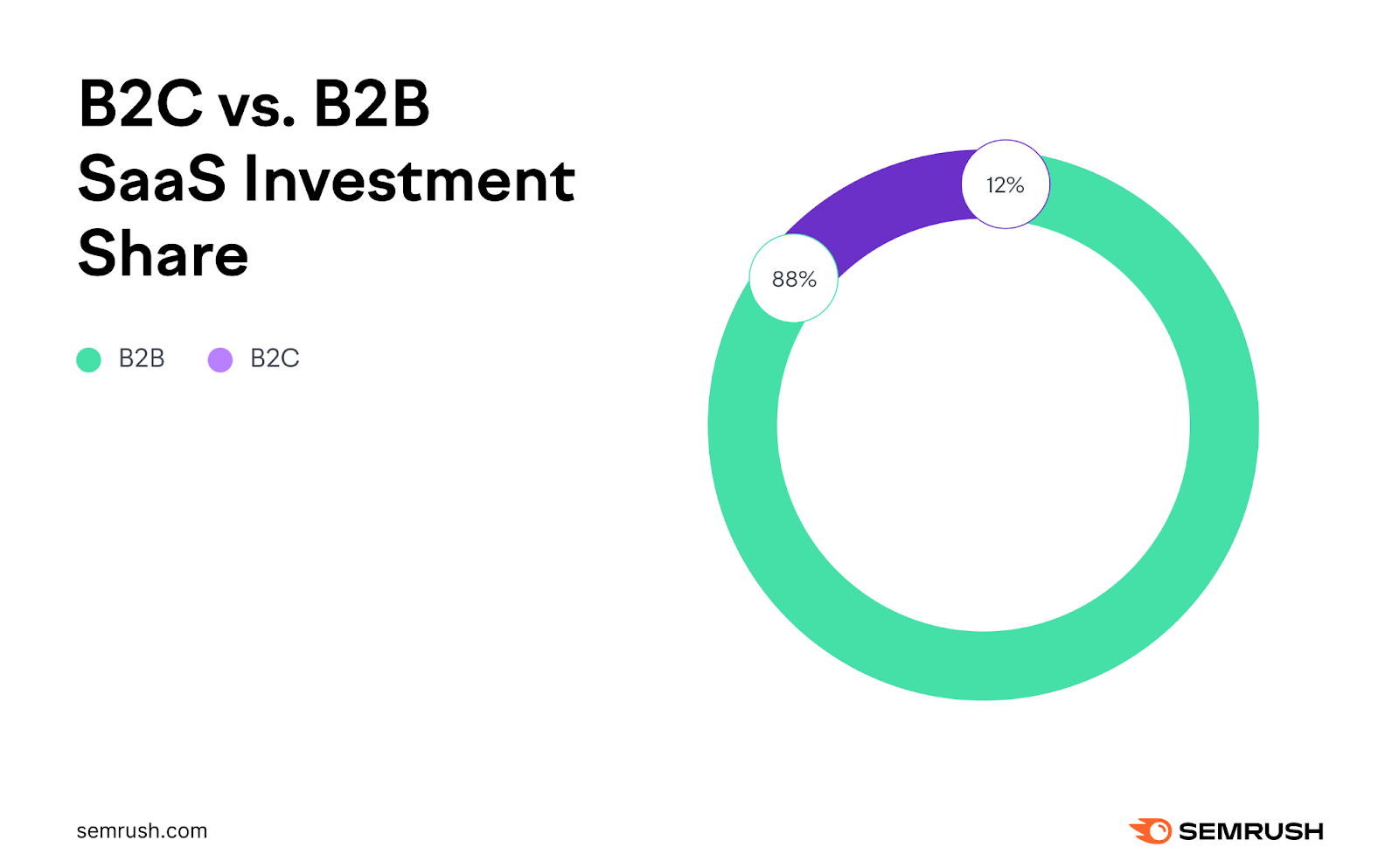

- Almost 90% of SaaS investment goes toward B2B companies (Dealroom, 2023)

Image Data Source: Dealroom

- At $14 billion, fintech is the B2B SaaS category that’s received the most venture capital funding (Dealroom, 2023)

Major Industries and Individual Players

SaaS spans a variety of industries—many of which contain a substantial workforce and extensive customer base.

Here’s a closer look at the major sectors and key players driving the SaaS market forward:

- The top SaaS industries by number of employees are financial services software, analytics software, and AI software. Each of these three industries has over 100,000 employees. (Statista, 2024)

- The top SaaS industries based on the total number of companies are AI software, analytics software, and financial services software. There are around 4,300 companies between these three industries worldwide. (Statista, 2024)

- AI software is the top SaaS industry by number of customers, with almost 3 billion customers worldwide (Statista, 2024)

- After AI software, the top SaaS industries by customer count are analytics software, ecommerce software, and security software—with around 1.9 billion customers each (Statista, 2024)

- Microsoft is the SaaS company with the largest market capitalization—over $3 trillion. Other major players include Apple, Alphabet, Oracle, Adobe, Intuit, IBM, and ServiceNow. (Statista, 2024)

- Microsoft has the greatest share of the SaaS market revenue, with about 22% of the market (Statista, 2023)

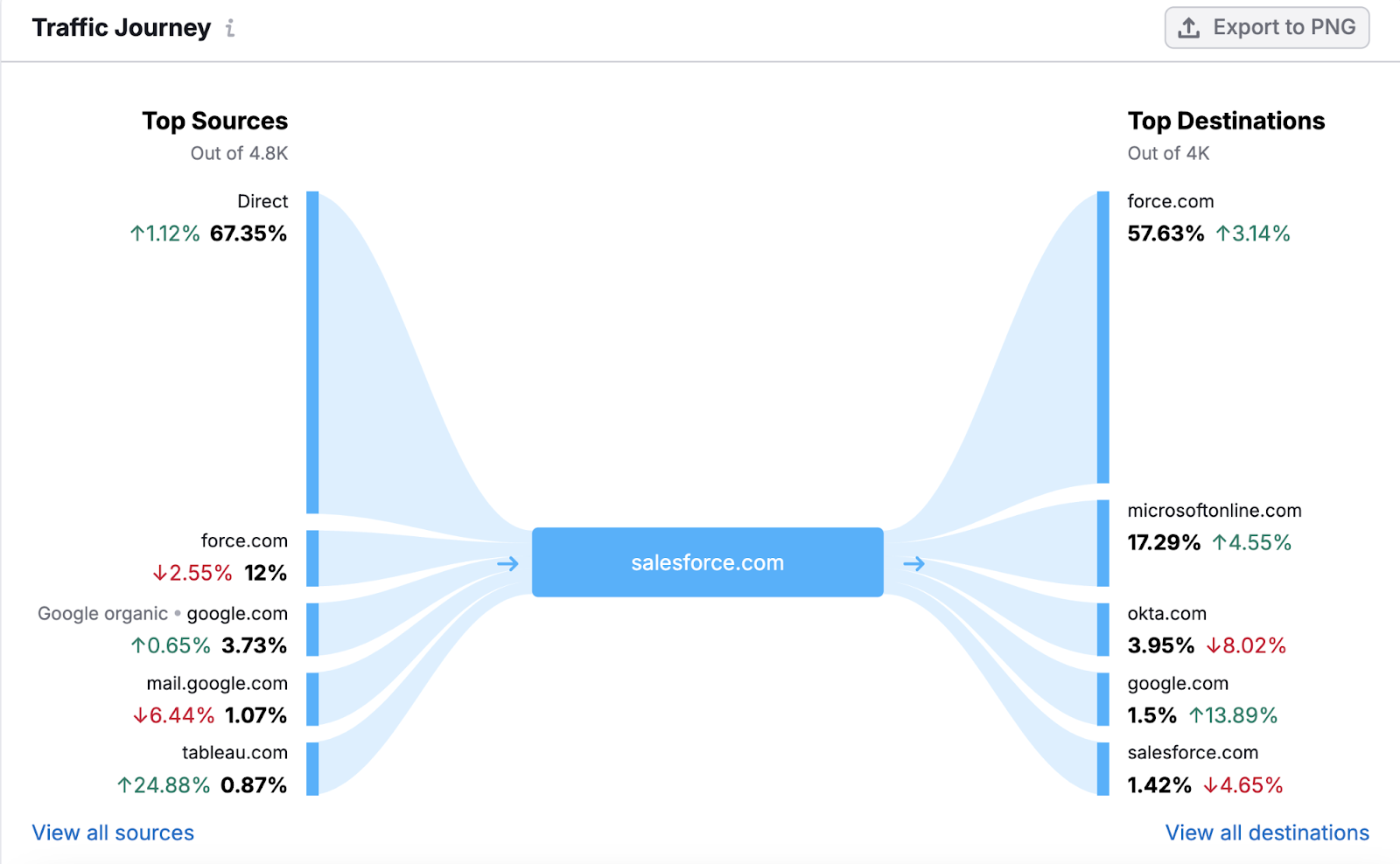

- Salesforce is the biggest company primarily focused on SaaS listed on the U.S. stock market (by market capitalization). Other top contenders include Adobe, ServiceNow, Intuit, and Shopify. (Mike Sonders, 2024)

Image Data Source: Mike Sonders

- Salesforce’s annual revenue reached almost $35 billion in its 2024 fiscal year (Salesforce, 2024)

- Oracle’s annual revenue reached $53 billion in its 2024 fiscal year. Over $39 billion of this revenue came from the company’s cloud services and license support division. (Oracle, 2024)

- SAP—an enterprise software company based in Germany—generated €31 billion in revenue in 2023. Almost €27 billion of this came from cloud and software sales. (SAP, 2023)

If you’re a SaaS marketer, researching how your closest competitors acquire traffic can help you improve your own web strategy.

The Traffic Analytics tool allows you to dig into your competitor’s website data. You can see which of their pages drive the most engagement, where their traffic comes from, and the extent to which your online audiences overlap.

International Markets

SaaS continues to grow across global markets, with various regions contributing significantly to the industry’s expansion.

Here’s a look at some of the main regions driving SaaS adoption and revenue:

- North America dominates the worldwide SaaS market, claiming 44% of global revenue (Grand View Research, 2023)

- The U.S. SaaS market is forecast to reach $445.6 billion by 2029 (Statista, 2024)

- There are around 9,100 SaaS companies in the U.S. and about 15 billion global customers among them, putting the U.S. in the lead (Statista, 2024)

- The U.K. is next and has 1,500 SaaS companies. And Canada is third, with 992 companies. (Statista, 2024)

- By 2029, the German SaaS market is expected to reach $38.9 billion (Statista, 2024)

- The Indian SaaS market is forecast to generate $26.4 billion by 2026 (Statista, 2023)

- China’s SaaS market is forecast to reach $29.8 billion in 2027 (Statista, 2024)

SaaS Financial Statistics

Company Revenue

Revenue and profitability vary widely across SaaS companies, along with funding sources and growth strategies.

These stats give a snapshot of how different types of SaaS companies perform financially:

- Almost 80% of bootstrapped companies are profitable or breaking even. This figure is just 37% for equity-backed companies. (SaaS Capital, 2024)

- In 2023, bootstrapped companies reported a median growth of 25%. While equity-backed companies reported a median growth of 30%. (SaaS Capital, 2024)

- High-growth SaaS companies spend 50% or more of their revenue on sales and marketing (McKinsey & Company, 2021)

- The median revenue per employee for private SaaS companies is $125,000 (SaaS Capital, 2024)

- Equity-backed SaaS companies with $1 million to $3 million in annual recurring revenue (ARR) have a median ARR per employee of $73,333. This figure is $108,000 for bootstrapped companies. (SaaS Capital, 2024)

User Spending

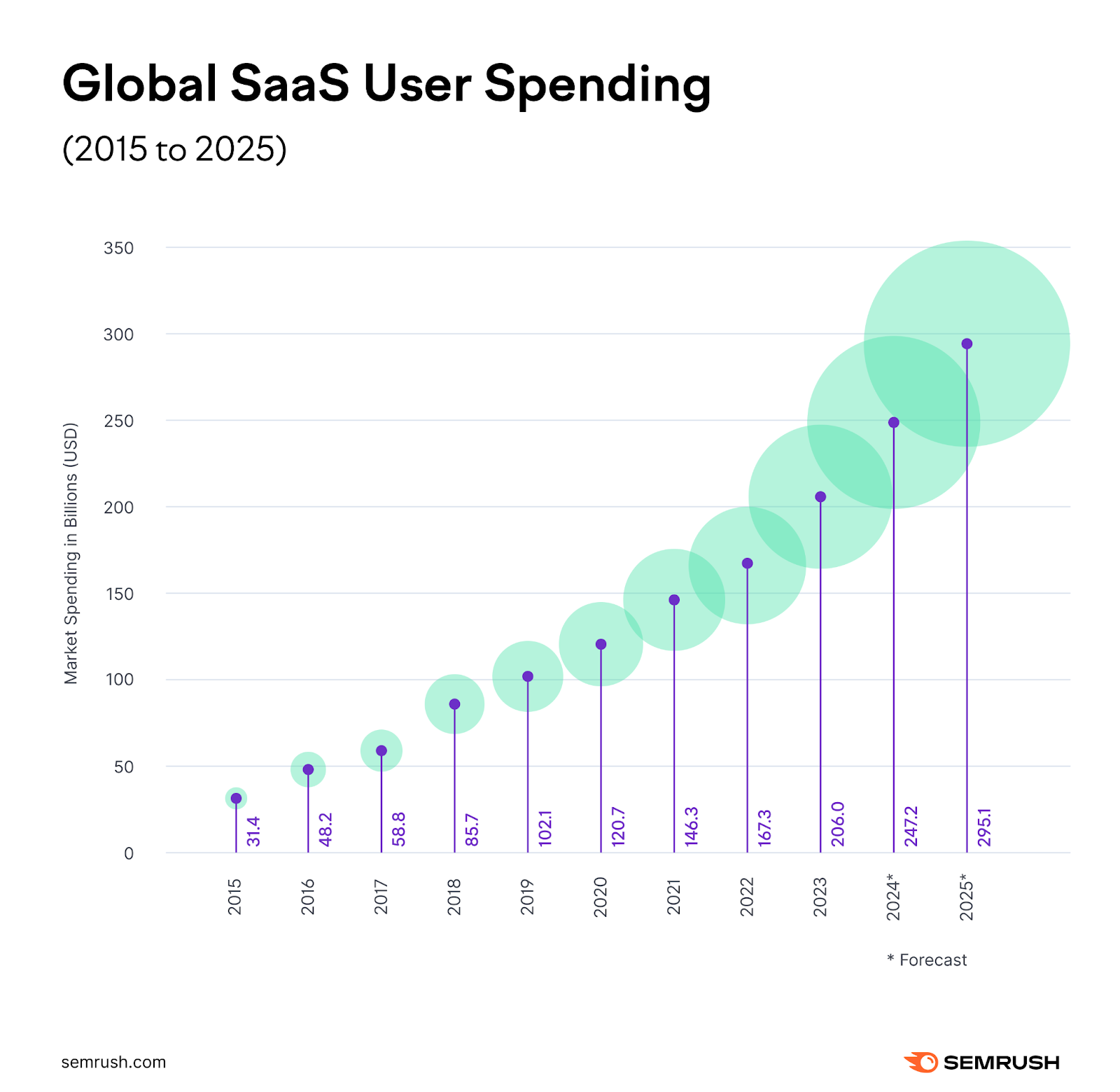

Businesses of all sizes continue to invest heavily in SaaS solutions, with recent price increases also contributing to the rise in spending.

Here’s a closer look at current spending patterns in the SaaS market:

- Global user spending on SaaS is estimated to reach over $295 billion in 2025. (Statista, 2024)

Image Data Source: Statista

- Almost 35% of Businesses spend between $2.4 million and $12 million on SaaS solutions (Statista, 2024)

- In 2024, businesses spend around $8,700 per employee on SaaS products. This is up from $7,900 in 2023. (Vertice, 2024)

- About 45% of small- to medium-sized businesses (SMBs) report spending up to $600,000 annually on SaaS. While around 16% spent up to $2.4 million. (Statista, 2024)

- The cost of SaaS solutions has increased by 33% since 2021 (BetterCloud, 2024)

- On average, SaaS prices increased by 12% between 2022 and 2023 (Vertice, 2023)

- Globally, the SaaS inflation rate is almost four times higher than the standard market inflation rate (Vertice, 2024)

Pricing Models

SaaS companies use a mix of pricing strategies to meet diverse customer needs and market demands.

Here are some of the key pricing trends shaping SaaS today:

- Of surveyed SaaS companies, 23% have usage-based subscription tiers. And 18% have a largely usage-based model (OpenView Venture Partners, 2023)

- Around 60% of surveyed SaaS companies make an effort to adapt their pricing to local markets (OpenView Venture Partners, 2023)

- About one-third of global survey respondents say per-user pricing is their preferred pricing model. Use-based pricing came in second place, with around 30% of votes. (Statista, 2024)

- Only 45% of SaaS companies publish their pricing (OpenView Venture Partners, 2021)

- Around 60% of SaaS vendors deliberately mask price increases (Vertice, 2024)

SaaS Use and Adoption Statistics

Use and Purchasing Decisions

The decision-making process for SaaS purchases is influenced by several factors, from security concerns to productivity goals.

Here are some stats to illustrate how organizations choose their SaaS solutions.

- Organizations use 112 SaaS apps on average (BetterCloud, 2024)

- Of surveyed businesses, 37% say boosting productivity is their main reason for buying new software. Other top reasons include addressing security concerns (30%), expanding product offerings (27%), and targeting new customers (26%). (Gartner, 2023)

- More than 40% of businesses say that security is their top consideration when buying new software (Gartner, 2023)

- More than 80% of software buyers take into account a vendor’s history with software breaches when studying software solutions (G2, 2024)

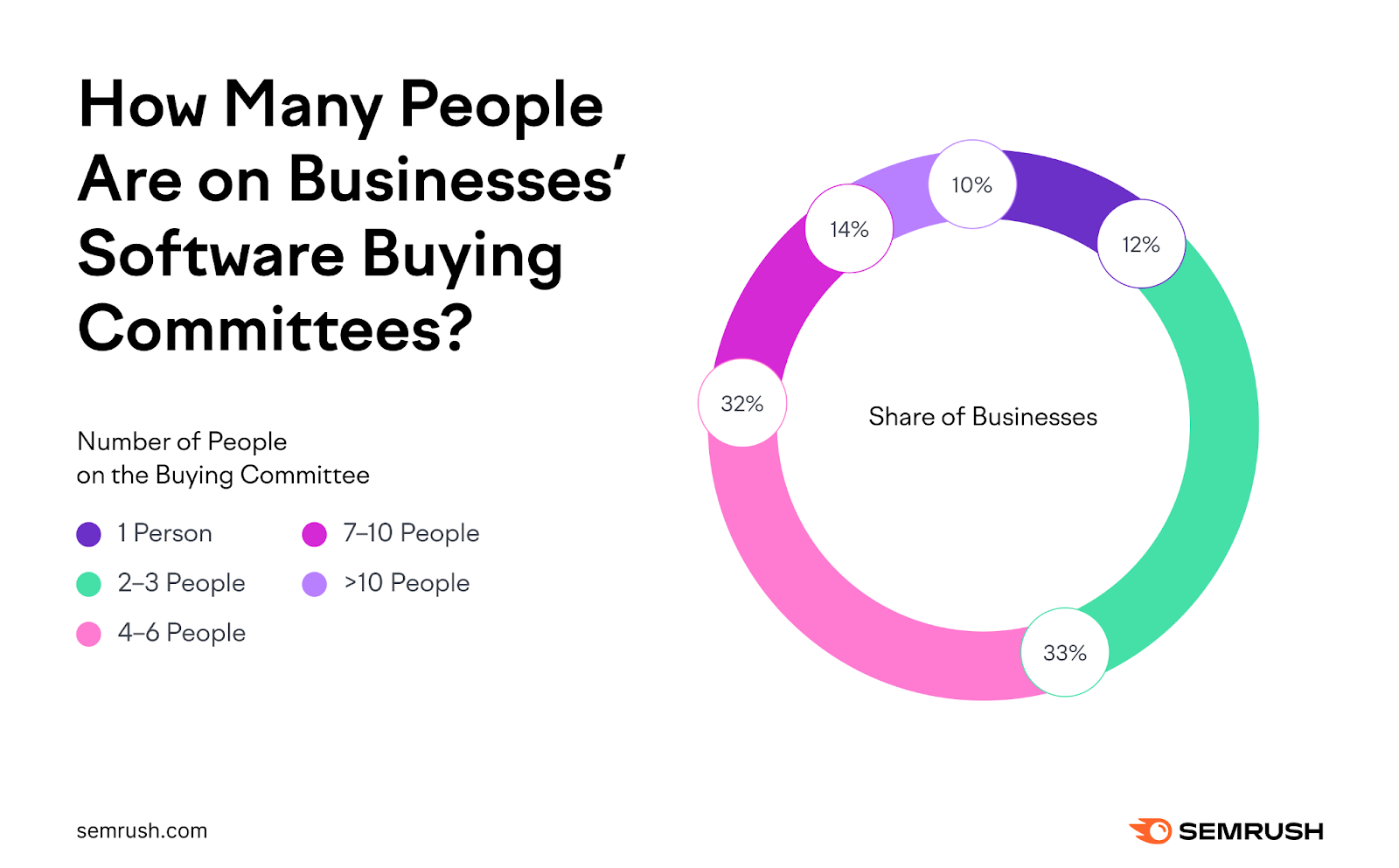

- For 33% of businesses, there are two to three people on the software buying committee (Gartner, 2024)

Image Data Source: Gartner

- Almost 40% of businesses always involve the finance team in software purchase decisions (Gartner, 2024)

- Over 50% of organizations scrutinize their SaaS purchasing decisions more than in previous years (BetterCloud, 2024)

- Around 40% of SaaS licenses are going unused (Productiv, 2024)

- The average company wastes over $135,000 in unused software licenses (BetterCloud, 2024)

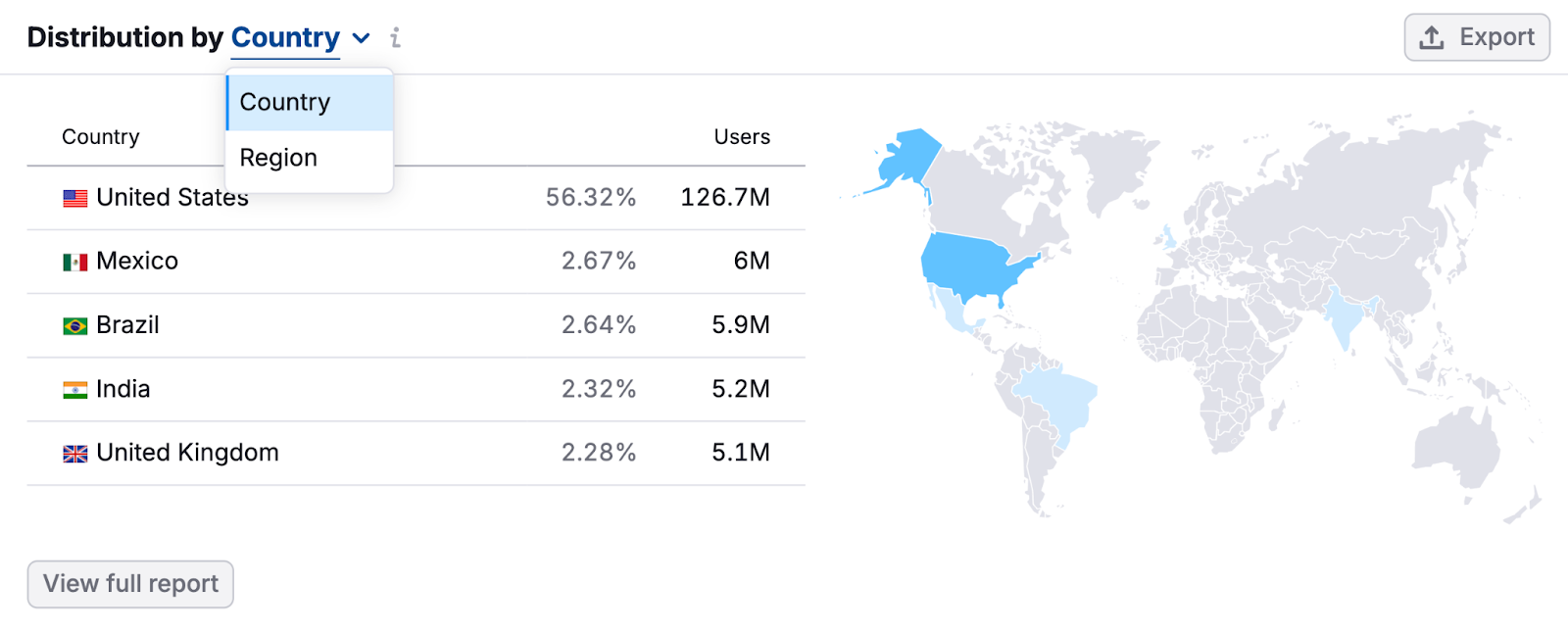

If you’re a SaaS marketer looking to gain more users, do thorough audience research to learn details about your ideal buyers that can boost your acquisition efforts.

You can browse resources like industry reports. Or, use Semrush’s One2Target tool.

It enables you to analyze audience demographics, socioeconomic data points, and identify key customer behaviors and preferences.

After you’ve conducted research, use what you learn to create targeted marketing campaigns that are more likely to attract and engage your ideal customers.

Churn

Minimizing customer churn is a top priority for SaaS companies.

Here are a few insights into the current state of customer retention within the SaaS space:

- In March 2024, the average B2B SaaS churn rate was -1.59%. That’s 12% lower than in March 2023. (Paddle, 2024)

- In 2023, 68% of businesses replaced software more frequently than in 2021 (Gartner, 2023)

- Of B2B SaaS companies with knowledge of how their integrations affect churn, 92% report less churn by customers who use integrations (Partner Fleet, 2024)

SaaS Trend Statistics

AI

AI is rapidly transforming the SaaS industry, with AI-driven features becoming key growth drivers.

Here are some stats reflecting how AI might shape the future of SaaS:

- The AI SaaS market is valued at $71.5 billion. This is set to increase to $775.4 billion by 2031. (Verified Market Research, 2024)

- In 2023, 76% of surveyed SaaS companies had launched or planned to launch AI features (OpenView Venture Partners, 2023)

- Over 62% of survey respondents say they think AI is the emerging trend that will have the greatest impact on the global SaaS market (Statista, 2024)

Further reading: 78 Artificial Intelligence Statistics and Trends for 2024

Integrations

Seamless integration with existing systems is a critical factor for SaaS success, driving both customer satisfaction and revenue growth.

Here are some key insights into the role of integrations in the SaaS market.

- Nearly 40% of buyers say ease of use with existing systems is a top consideration when buying software (Gartner, 2024)

- B2B SaaS companies say that 35% of upsells are driven by integrations (Partner Fleet, 2024)

- The top 50 software companies’ marketplaces have 1,498 apps on average (HubSpot, 2024)

Use SaaS Statistics to Plan Your Strategy

Because of the demand for scalable, cloud-based solutions that enhance business productivity and security, SaaS shows no signs of slowing down.

That’s great news if you’re in the industry.

And you can combine what you learned from the above stats with Semrush .Trends to do audience and competitor research that’s likely to yield better results.

Try it today.