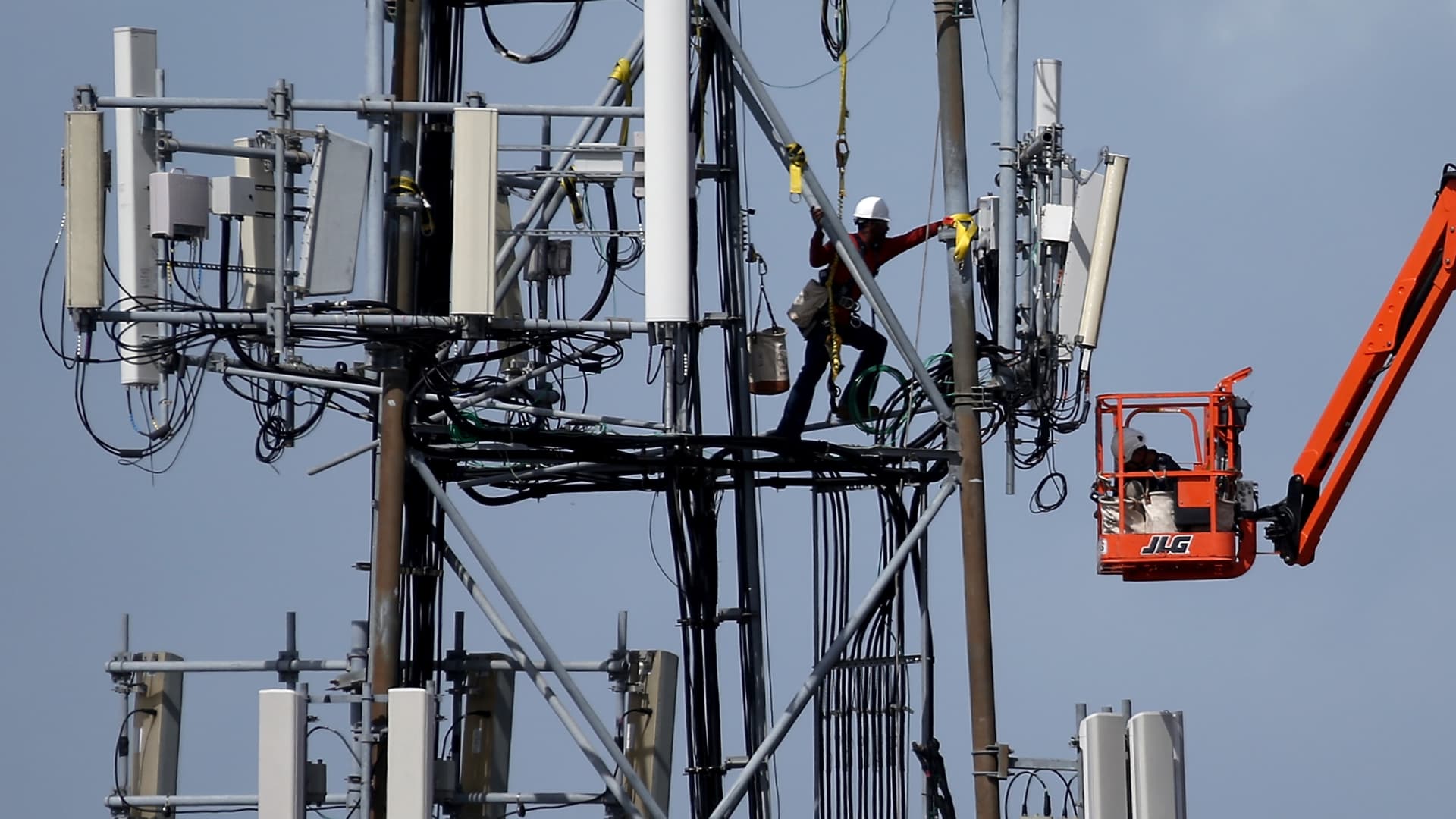

A WeWork co-working office space in Berkeley, California, on Wednesday, Aug. 9, 2023.

David Paul Morris | Bloomberg | Getty Images

WeWork CEO David Tolley, who took over the office-sharing company in an interim role in May, wrote in a public letter on Wednesday that the embattled business is “here to stay” and that it’s immediately undergoing an effort to rework its leases worldwide.

“Today, we are kicking off a process of global engagement with our landlords to renegotiate nearly all our leases,” Tolley wrote. “As part of these negotiations, we expect to exit unfit and underperforming locations and to reinvest in our strongest assets as we continuously improve our product.”

The latest chapter in the extended WeWork saga involves the company trying to stay solvent. It warned in a filing a month ago that bankruptcy could be a concern, as there’s doubt about its ability to keep operating as a “going concern” due to mounting losses and dwindling cash.

With its market cap at around $200 million, down from a private market peak of $47 billion, WeWork in mid-August announced a 1-for-40 reverse stock split to get its shares trading back above $1, a requirement for keeping its New York Stock Exchange listing. The stock had fallen to a low of around 10 cents and is now at $3.53 following the reverse split.

WeWork’s business has been on a downward slide since the company’s failure to conduct its initial public offering in 2019. Principal owner SoftBank poured billions of dollars into the business to try and rescue it, eventually getting it public through a special purpose acquisition company. But the combination of Covid shutdowns and the sputtering economy that followed have left WeWork with massive leases in buildings that are underoccupied and worth far less than what the company paid.

“Despite the important actions we’ve taken over time to improve our company and real estate footprint, our current lease liabilities – which were over two-thirds of total operating expenses in the second quarter – still remain too high and are dramatically out of step with current market conditions,” Tolley wrote. “We are taking immediate action to permanently fix our inflexible and high-cost lease portfolio to achieve the sustainable operating model that we need to serve our members for many years to come.”

Tolley, who has over 25 years of corporate experience, largely in private equity and restructurings, insists that WeWork isn’t going anywhere. But he has to work quickly. Cash and equivalents sank to $205 million as of June from $287 million at the end of December and $625 million in mid-2022.

“Let me finish by making one thing clear: WeWork is here to stay,” Tolley wrote.