A sign outside a Vodafone Group Plc mobile phone store in London, U.K.

Jason Alden | Bloomberg | Getty Images

Vodafone and CK Hutchison, which owns the Three UK mobile network, agreed to merge their U.K. businesses, following talks that have been ongoing since last year, the companies said Wednesday.

Vodafone will own 51% of the combined business, leaving CK Hutchison the minority stake.

“This long-awaited mega merger represents the biggest shake-up in the UK mobile market for over a decade,” Kester Mann, director for consumer and connectivity at CCS Insight said in emailed comments.

“The deal makes plenty of sense as both providers are sub-scale. As separate entities, it would have been near impossible for either to grow enough organically to come close to challenging BT or Virgin Media O2 for size. Inevitably however, there will be widespread fears over job cuts.”

Current Vodafone UK CEO Ahmed Essam will lead the new enterprise, while the present Three UK Chief Financial Officer (CFO) Darren Purkis will assume the CFO position at the merged business.

Vodafone has been going through a transition period since its former CEO Nick Read stepped down at the end of last year. Vodafone appointed Margherita Della Valle as permanent CEO in April to transform the business.

The combination of Vodafone’s U.K. business and Three UK will reduce the number of mobile operators in the country to just three, after major consolidation in the telecommunications sector in the past few years.

Vodafone and Three were lagging behind larger rivals EE, which is owned by BT, and O2, which is owned by Telefonica and Liberty Global via a joint venture. BT acquired EE in 2016, while Telefonica and Liberty Global launched Virgin Media O2 in 2021.

The deal will need approval from the U.K.’s Competition and Markets Authority (CMA) which has become increasingly-powerful and looked to hamper big mergers and acquisitions. Last month, the CMA moved to block Microsoft’s $69 billion acquisition of gaming firm Activision Blizzard.

Regulatory concerns

The merger is expected to complete before the end of 2024 and remains subject to regulatory and shareholder approvals — with some analysts questioning whether it will pass the finish line.

Back in 2016, the European commission blocked Three’s takeover of British telecommunication company O2 on competition concerns, setting a precedent that may prove challenging to overcome.

“This will be a hard sale given that both companies have been outperforming the market for the last year or so,” said Paolo Pescatore, tech, media and telco analyst at PP Foresight. “Let’s see if the authorities have a change of heart. Both parties need to demonstrate that this is genuinely in the interest of UK plc, the economy, and consumers for it to have a chance of getting over the line.”

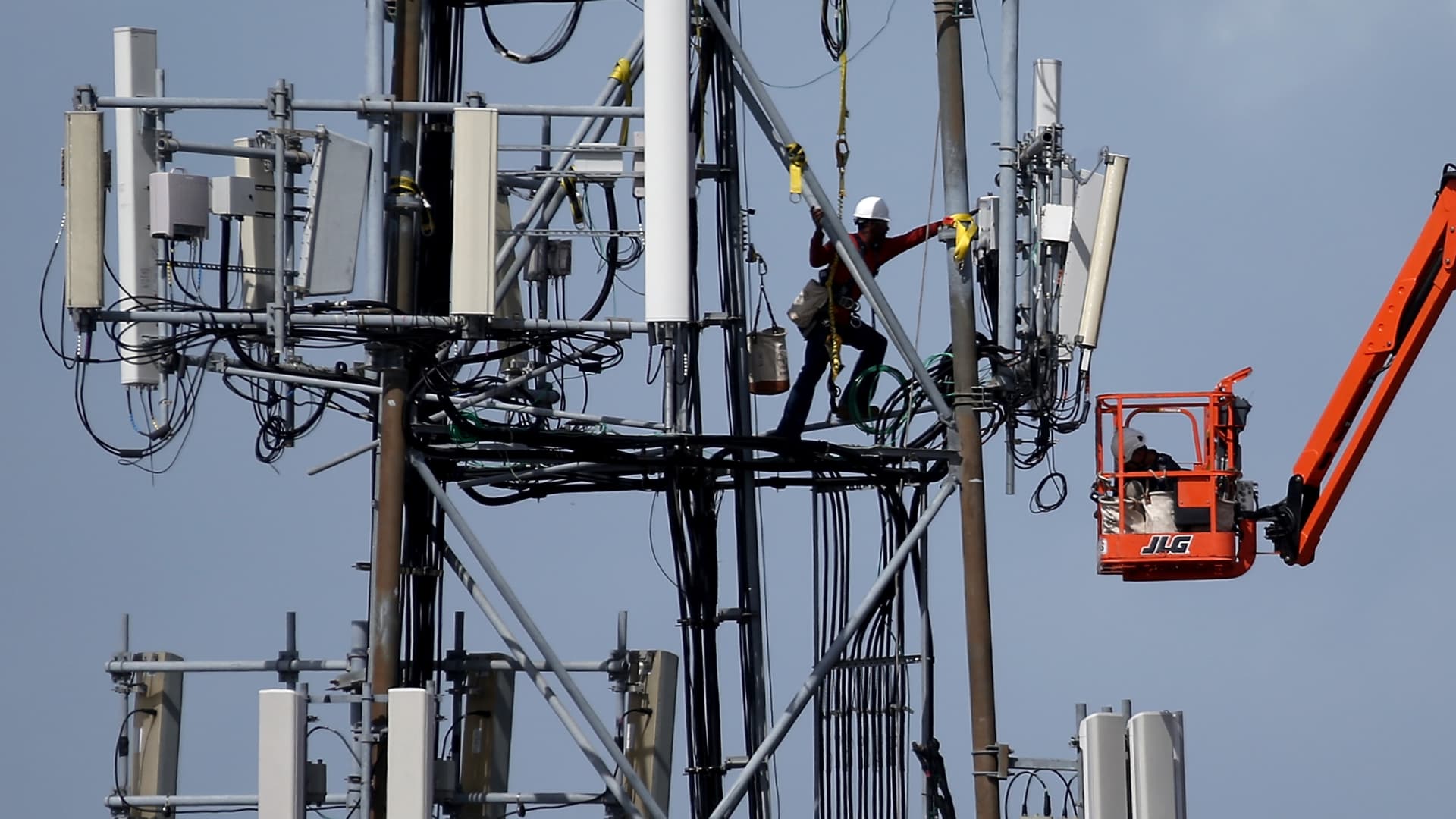

Vodafone and CK Hutchison touted the benefits of the tie-up, saying it will “deliver up to £5 billion per year in economic benefit by 2030, create jobs and support digital transformation of the UK’s businesses” and that “every school and hospital in the UK will have access to standalone 5G by 2030.

In a potential bid to sweeten the appeal of the deal to regulators, the new combined company will also invest £11 billion ($13.91 billion) in the U.K. over 10 years “to create one of Europe’s most advanced standalone 5G networks, in full support of UK Government targets.”

“An £11 billion network investment plan will seek to allay regulatory concerns. But this deal will still face a major challenge to win approval. At this stage, I believe it is too difficult to call either way,” CCS Insight’s Mann said.