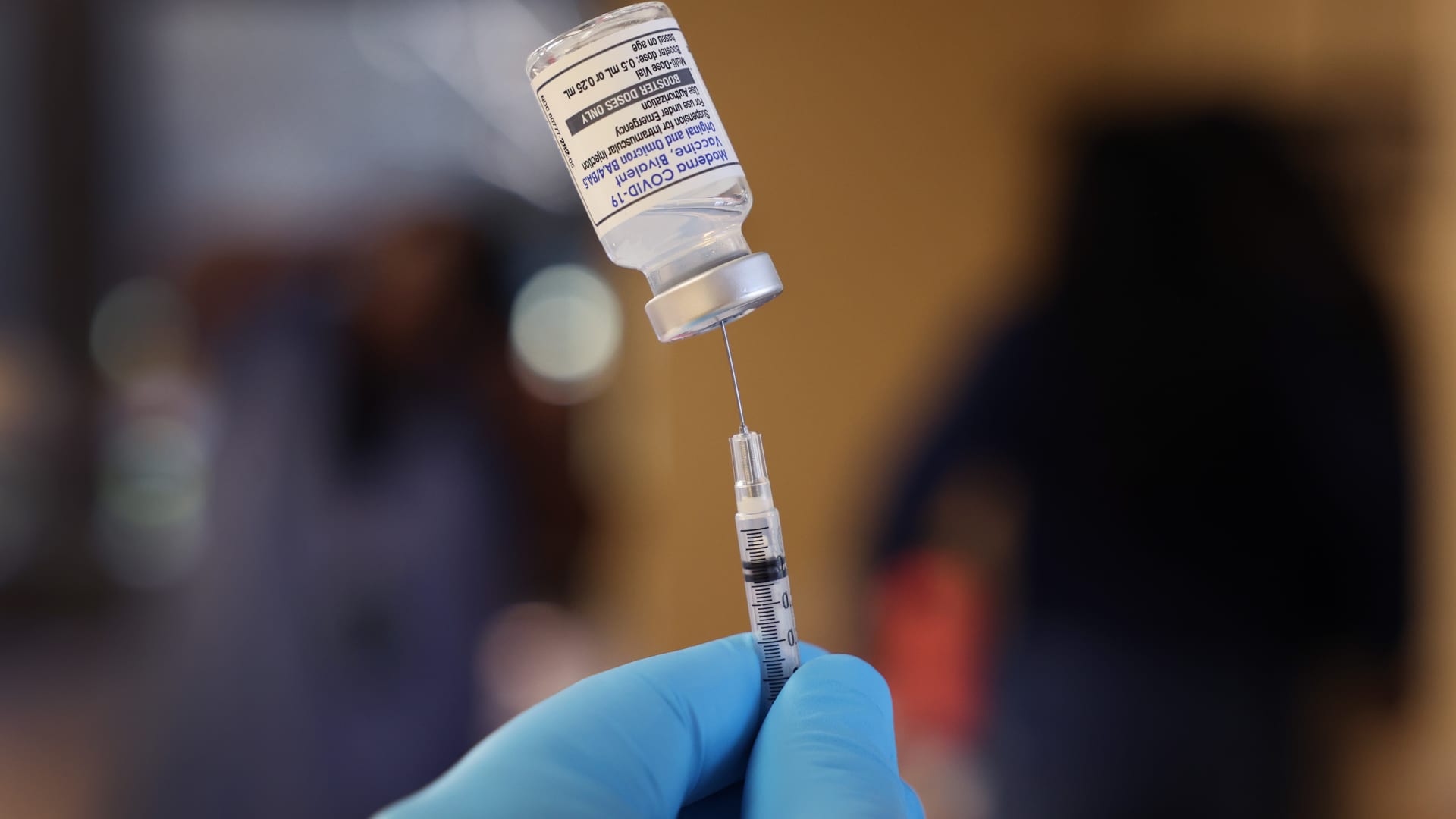

A pharmacist prepares to administer COVID-19 vaccine booster shots during an event hosted by the Chicago Department of Public Health at the Southwest Senior Center on September 09, 2022 in Chicago, Illinois.

Scott Olson | Getty Images

The U.S. Food and Drug Administration‘s Covid strain selection for the next round of shots puts Pfizer, Moderna and Novavax on track to deliver new jabs in time for the fall – a decisive win for the vaccine makers as they gear up to compete against one another.

The FDA on Friday advised the three companies to manufacture single-strain jabs targeting the omicron subvariant XBB.1.5, one of the most immune-evasive Covid variants to date.

That strain accounted for nearly 40% of all Covid cases in the U.S. in early June, but that proportion is slowly declining, according to data from the Centers for Disease Control and Prevention.

But facing pressure to deliver new shots by the fall, Pfizer, Moderna and Novavax began development on versions of their vaccines targeting XBB.1.5 months before the FDA’s decision. Preliminary data those companies presented last week indicates that their jabs produce strong immune responses against all XBB variants.

The FDA’s strain selection means that the companies won’t have to scramble to manufacture shots targeting an entirely different strain, which would delay the timing of delivery.

Pfizer said on Thursday it will be able to deliver a shot targeting XBB.1.5 by July. Moderna and Novavax did not provide specific timelines for their versions when asked by CNBC.

Still, the FDA’s decision means that all three companies will likely deliver their updated jabs on time.

Shots targeting XBB.1.5 seem “the most feasible to get across the finish line early without resulting in delays in availability,” Dr. Melinda Wharton, a senior official at the National Center for Immunization and Respiratory Diseases, said at an FDA advisory committee meeting on Thursday.

The U.S. is expected to shift Covid vaccine distribution to the private sector as soon as the fall, when the federal government’s supply of free shots is expected to run out. Manufacturers will sell their updated jabs directly to health-care providers rather than to the government.

That doesn’t include Johnson & Johnson, a once-leading Covid vaccine developer. The company’s shots are no longer available in the U.S. after reports of rare but serious blood-clotting side effects.

For Pfizer and Moderna, the commercial market is an opportunity to tap into more distribution channels than they did under government contracts.

But both companies still expect Covid-related sales to decline this year as the world emerges from the pandemic and fewer people rely on vaccines and treatments. Pfizer expects Covid shot revenue to fall to $13.5 billion this year from $37.8 billion in 2022.

Moderna expects a minimum of $5 billion in revenue from its Covid vaccine, its only available product. The jab generated $18.4 billion in revenue last year.

For Novavax, the commercial market is crucial to its survival through 2023 and beyond. The cash-strapped company won U.S. approval for its Covid vaccine under emergency use just last year due to regulatory and manufacturing delays.

Now, one of Novavax’s top priorities is to capture commercial market share after lagging behind Pfizer and Moderna. The FDA’s strain selection positions Novavax as a viable competitor against those household names.

The company hopes to rake in $1.06 billion to $1.24 billion in sales of its Covid vaccine this year. That’s slightly lower than the $1.5 billion Novavax’s shot generated last year.

But the three companies still face the same hurdle: It’s unclear how many Americans will roll up their sleeves to take updated vaccines later this year, even if those shots are delivered on time.

Only around 17% of the U.S. population — around 56 million people — have received Pfizer and Moderna’s latest boosters since they were approved in September, according to the CDC.